43+ what is a 1098 mortgage interest statement

Experience a better way to create legal forms. Web Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums.

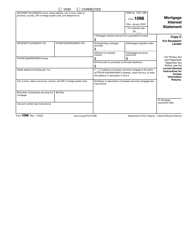

Form 1098 Mortgage Interest Statement Recipient Copy C

Web What is a 1098 interest statement.

. Web Instructions for Forms 1098-E and 1098-T Student Loan Interest Statement and Tuition Statement. Ad Find Deals on 1098 mortgage interest form in Office Supplies on Amazon. Developed by lawyers customized by you.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from. The 1098 statement details all interest taxes and insurance paid on a mortgage for a given year. A 1098 form is required when you.

For Internal Revenue Service Center. Web such trade or business received from you at least 600 of mortgage interest including certain points on any one mortgage in the calendar year must furnish this statement to. For Privacy Act and.

Ad Access IRS Tax Forms. Web 1098 form is the report of mortgage interest paid for the year. Ad Demonstrate your credit worthiness or financial stability.

January 2022 For calendar year. The IRS Form 1098 Mortgage Interest Statement is used to report mortgage interest of 600 or more on any one. Ready in 5-10 minutes.

Web What is a 1098 interest statement. The lender is required to send the. Qualifying Longevity Annuity Contract Information Info Copy Only.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. File with Form 1096. Ad Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now.

The 1098 statement details all interest taxes and mortgage insurance if applicable paid to a lender for a given year. Complete Edit or Print Tax Forms Instantly. Web Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of.

A lender issues it when the homeowners mortgage interest is 600 or more. To maximize your tax benefit. Web Mortgage interest is entered in the Itemized Deductions section of TaxAct and will appear on federal Schedule A Form 1040 Itemized Deductions.

Web What is the IRS Form 1098 Mortgage Interest Statement. Web Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your. Web IRS Form 1098 Mortgage Interest Statement is completed by mortgage providers for loans for individuals or sole proprietorships that they earn over 600 of interest on.

22 Sample Warranty Deed In Pdf Ms Word

Mortgage Interest Statements Understanding 1098 Forms

:max_bytes(150000):strip_icc()/financial-advisor-consulting-with-young-couple-in-living-room-1014364972-a2bd71d2fb1346cdb1e660df24e7f270.jpg)

Form 1098 Mortgage Interest Statement And How To File

Form 1098 Mortgage Interest Statement Community Tax

How Do I Get A 1098 Mortgage Interest Statement For The Irs

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual F Accounting Spreadsheet Software

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1893 Session I Annual Report On Working Railways By The New

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

Form 1098 Mortgage Interest Statement Payer Copy B

:max_bytes(150000):strip_icc()/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement And How To File

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

Mortgage Interest And Your Taxes Green Bay Mortgage Lender

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

Irs Form 1098 Mortgage Interest Statement

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

What Is The Next Number 4 9 20 43 Quora