Margin call options

Interest accrues daily and is posted. Rates subject to change.

What Is Margin And Should You Invest On It

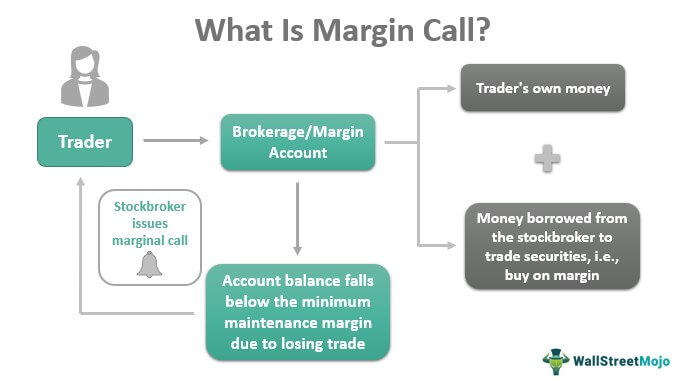

A margin call is when CommSec requires a client who has written options to provide additional cash or stock as collateral for their open positions.

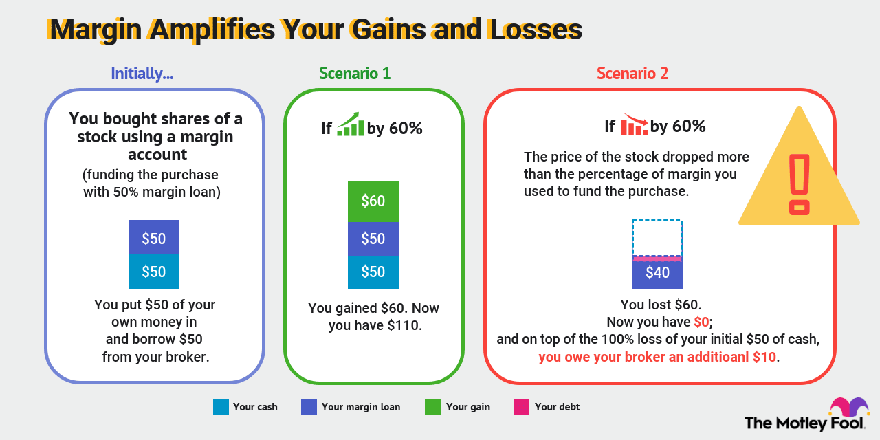

. Download Smart Options Strategies free today to see how to safely trade options. When you sell an option you receive immediate cash but you take on an. The biggest risk of margin trading is that you may lose more money than you originally invested.

Base Rate 0075. Total margin option delta x spot margin vega margin So for example if you sold one option contract with delta of 05 you. T is a legal requirement to fund a purchase of securities in a margin account with at least 50 cash.

Margin for options example. These formulas make use of the functions Maximum x y Minimum x y and If x. Margin Call Options Trading.

Margin Requirements Applies to Stock Index Options A minimum available equity of 2000 is required for. Ad Amp Up Your Trading with Margin and Leverage. Your spread betting company calls you and requests that you put an additional 100 into your account to cover your open loss.

View the basic AMC option chain and compare options of AMC Entertainment Holdings Inc. Margin rates as low as 283. To determine how many shares would be necessary to meet a 2000 margin call Ellen divides 2000 by the loan value of the stock she plans to deposit.

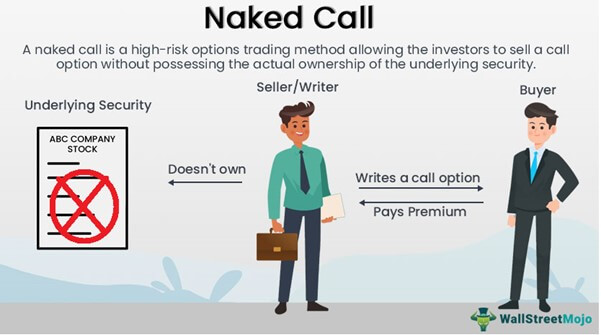

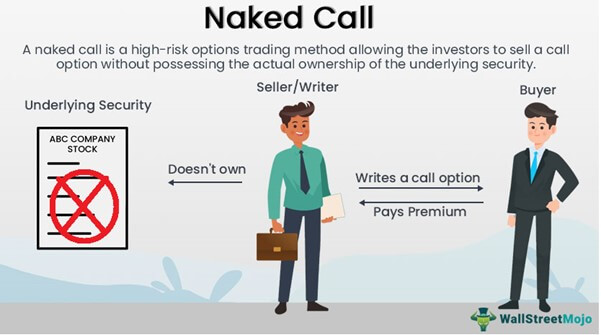

See how this trading course helps small investors earns Extra Income. Be Your Own Boss. In options trading margin also refers to the cash or securities required to be deposited by an option writer with his brokerage firm as collateral for the writers obligation to buy or sell the.

Calls for September 16 2022. If an investors account value drops to a level where a margin call is issued by their broker the investor typically has two to five days to meet it. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

The following tables show option margin requirements for each type of margin combination. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Ad Amp Up Your Trading with Margin and Leverage.

What is an Options Margin Call. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. The loan value is equal to 100.

Margin math on options is at least partially based on fear Image source. Margin requirements are established by the. Ad Best Online Forex Trading Course.

To sell one option contract the initial margin would be. 32 rows Options Margin Requirements TradeStation Securities Inc. Book Your Spot Now.

This schedule contains a description of Exchange margin requirements for various positions in put options call options combination put-call positions and underlying positions offset by. Your interest rate depends on your debit balance and Schwabs base rate. Earn Extra Income Work From Home.

Option margin is the cash or securities an investor must deposit in their account as collateral before writing or sellingoptions. By law you must meet the margin call within five. A federal margin call Reg.

Investing is a method to reserve money while you are hectic with life and have that money work for you so that you can completely enjoy the benefits of your. When investors trading on a margin and they experience losses they may. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget.

Using the margin call. We Create Successful Currency Traders. The premium received is Rs 10 for the strike price of 970 and we assume a margin.

Contract Name Last Trade Date Strike Last. Maintenance margin is the minimum. A sells 1 lot lot size is 600 shares of call option of Infosys.

A margin call happens when you owe your broker money and they sell your assets or ask you for immediate cash to pay down debt in your margin account.

What Is A Margin Call Babypips Com

Margin Call Overview Formula How To Cover Margin Calls

Margin Call Price Formula And Calculator Excel Template

Margin Call Price Formula And Calculator Excel Template

Naked Call Option Definition Examples Calculations

How To Handle Margin Calls Youtube

Margin Call Price Formula And Calculator Excel Template

Margin Call Meaning Explanation Examples Calculation

Margin Call What It Is And How To Meet One With Examples

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

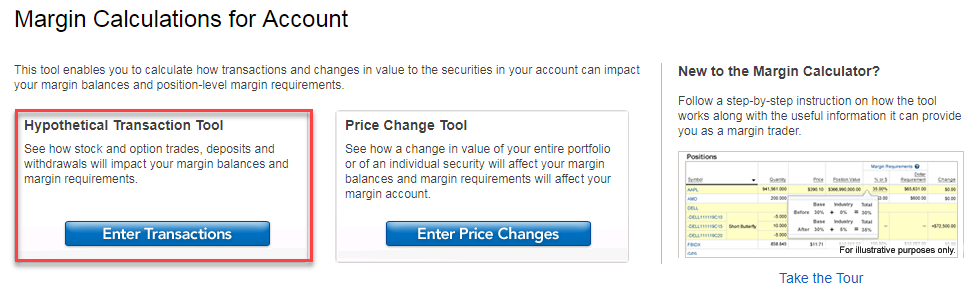

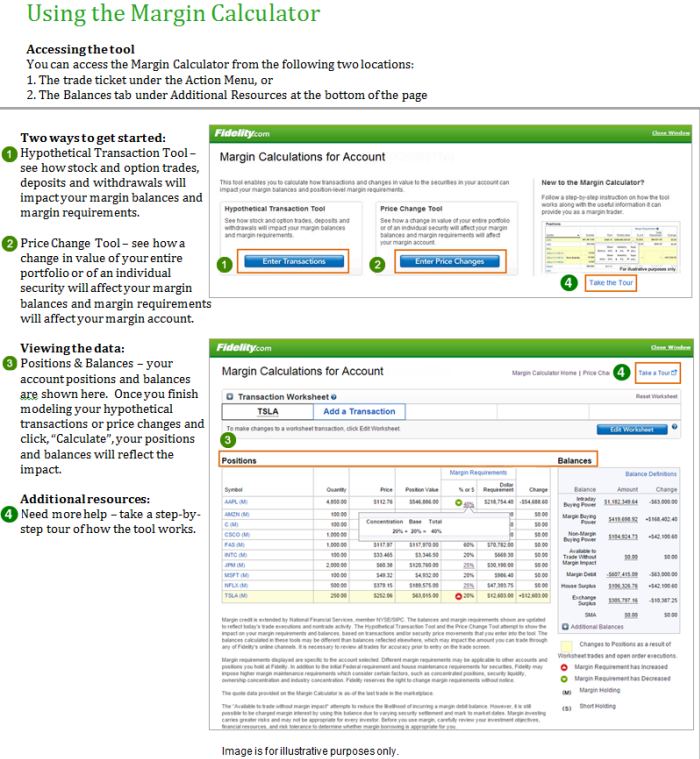

Trading Faqs Margin Fidelity

Margin Call Price Formula And Calculator Excel Template

What Is A Margin Call Babypips Com

What Is A Margin Call Margin Call Formula Example

What Is A Margin Call Babypips Com

Avoiding And Managing Margin Calls Fidelity

Trading Faqs Margin Fidelity